Can bankruptcy help you?

Schedule today to speak with a local, experienced bankruptcy attorney and find out.

Serving Upstate South Carolina

Consultations are free.

✅ Attorney appointments every weekday

✅ Prepare your case directly with your attorney

✅ Easy payments that you control

✅ Small starting payments

✅ Detailed explanations at every step of your case preparation

✅ Thorough hearing preparation

✅ 15 years of practicing bankruptcy in Upstate South Carolina

Directing attorney, Malinda M. Pennington, works closely with individuals in South Carolina, providing personal and diligent bankruptcy representation.

When you schedule a phone consultation appointment, attorney Pennington will help you determine whether bankruptcy can help you. During your phone consultation expect to review your debt, household size, income, assets, and some hearing questions that may indicate a necessary delay.

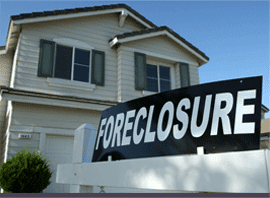

Attorney Pennington also provides an option for quickly filing Chapter 13 in the case of foreclosure. Call today if you need to stop a foreclosure or foreclosure sale on your primary residence.